In recent times, the idea of investing in gold has gained vital traction among traders, particularly those looking to diversify their retirement portfolios. If you loved this article and you would certainly like to obtain more details relating to reliable ira companies for gold investments kindly see our own web-site. This case study explores the strategy of transferring a person Retirement Account (IRA) to gold, the advantages and challenges associated with such a transfer, and the implications for long-term financial security.

Understanding Gold IRAs

A Gold IRA is a type of self-directed IRA that enables buyers to hold physical gold and other precious metals as a part of their retirement portfolio. Not like traditional IRAs, which typically hold stocks, bonds, and mutual funds, Gold IRAs present a hedge towards inflation and market volatility. Investors typically turn to gold throughout financial uncertainty, making it a gorgeous possibility affordable companies for ira rollover gold investments those wanting to guard their retirement savings.

The Case of John and Mary: A Sensible Instance

John and Mary, a couple in their late 50s, had been contributing to their conventional IRA for over two a long time. With retirement on the horizon, they started to rethink their investment technique. After conducting in depth analysis and consulting with a financial advisor, they determined to switch a portion of their IRA into a Gold IRA.

Step 1: Analysis and Consultation

The first step in John and Mary’s journey was to educate themselves about Gold IRAs. They realized about the advantages of investing in gold, together with its historical stability and capability to act as a secure options for ira precious metals rollover haven during economic downturns. They also consulted with a financial advisor who specialized in valuable metals to grasp the implications of transferring their IRA.

Step 2: Choosing a Custodian

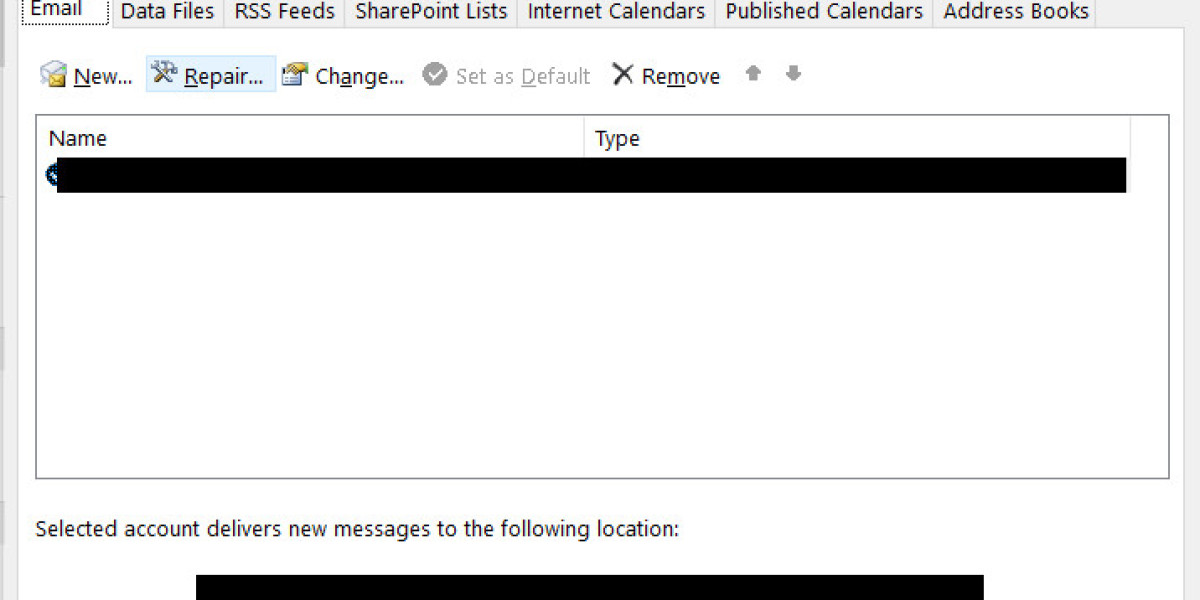

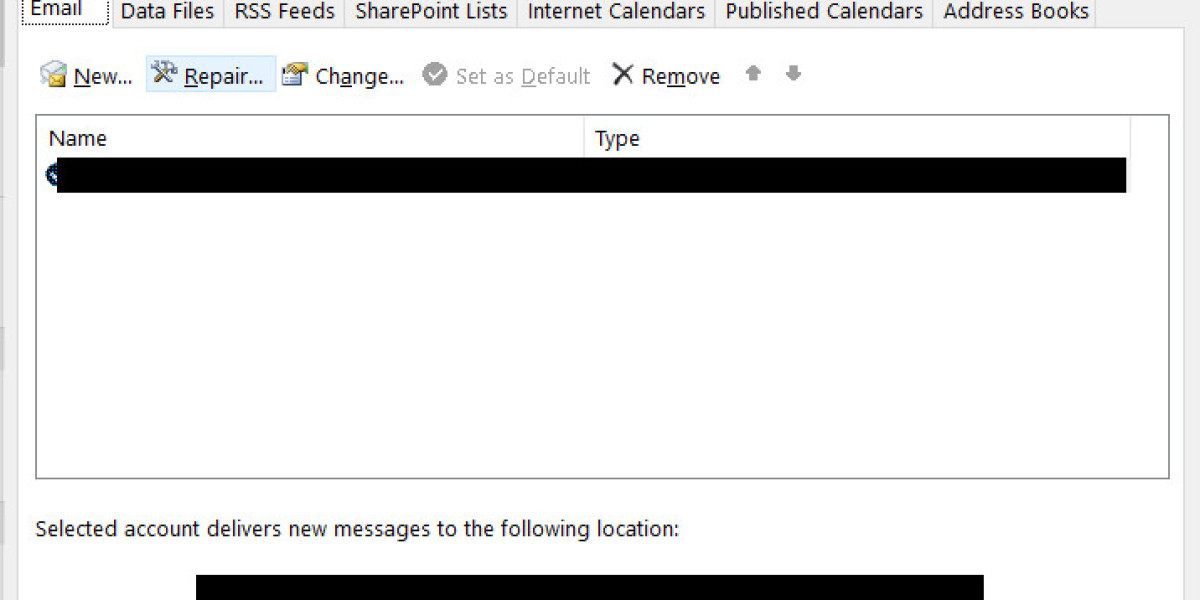

To initiate the switch, John and Mary needed to pick a custodian that specialised in Gold IRAs. The custodian could be answerable for managing their account and guaranteeing compliance with IRS laws. After evaluating several custodians, they selected one with a solid reputation, clear charge construction, and glorious customer support.

Step 3: Initiating the Transfer

Once they selected a custodian, John and Mary accomplished the mandatory paperwork to initiate the switch of their conventional IRA to a Gold IRA. This course of involved filling out a switch request type and offering documentation of their existing IRA holdings. They opted for a direct switch, which allowed the funds to move from one account to another with out incurring taxes or penalties.

Step 4: Choosing Gold Investments

With the switch underway, John and Mary labored with their custodian to pick out the types of gold investments they wanted to include in their IRA. They selected to spend money on gold bullion coins and bars, that are recognized for his or her purity and worth. The couple additionally thought-about other treasured metals, similar to silver and platinum, to further diversify their holdings.

Benefits of Transferring to a Gold IRA

- Safety Against Inflation: Gold has historically maintained its worth over time, making it a dependable hedge towards inflation. As the price of living rises, the worth of gold usually increases, serving to to preserve purchasing power.

- Diversification: By together with gold in their retirement portfolio, John and Mary had been able to diversify their investments. This lowered their general danger publicity, as gold often behaves differently than stocks and bonds throughout market fluctuations.

- Tangible Asset: Not like stocks or mutual funds, gold is a bodily asset that buyers can hold. This tangibility gives a sense of security, particularly during times of financial uncertainty.

- Potential recommended companies for gold ira rollover Progress: While gold is usually viewed as a safe-haven funding, it may also admire over time. Historic developments show that gold costs tend to rise during periods of economic instability, offering potential for capital gains.

Challenges and Considerations

Whereas transferring an IRA to gold affords numerous benefits, it isn't with out its challenges. John and Mary faced several considerations during their transition:

- Storage and Security: Bodily gold must be saved securely to guard it from theft or harm. Their custodian provided choices for safe storage, but John and Mary needed to consider these extra prices.

- Market Volatility: Though gold is often seen as a stable funding, its worth will be risky in the brief time period. John and Mary needed to be prepared for potential fluctuations in the value of their gold holdings.

- Charges and Prices: Investing in a Gold IRA sometimes involves varied charges, including custodial fees, storage fees, and transaction costs. John and Mary carefully reviewed the payment structure of their chosen custodian to ensure that they understood all associated prices.

- Regulatory Compliance: The IRS has particular rules governing Gold IRAs, including the forms of metals that can be held and the purity necessities. John and Mary relied on their custodian to make sure compliance with these regulations.

Conclusion: A Strategic Transfer for Monetary Safety

Transferring an IRA to gold generally is a strategic transfer for individuals looking for to reinforce their monetary security as they strategy retirement. John and Mary’s case illustrates the importance of analysis, session, and cautious planning in making this transition. By diversifying their retirement portfolio with gold, they positioned themselves to better withstand financial uncertainties and protect their arduous-earned financial savings.

As the economic landscape continues to evolve, more buyers might consider the advantages of Gold IRAs as a technique of safeguarding their financial future. The case of John and Mary serves as a valuable instance of how knowledgeable decision-making can lead to a extra secure retirement.