In the ever-evolving landscape of retirement planning, individual retirement accounts (IRAs) have become a staple for many investors seeking long-term financial security. Among the various types of IRAs available, Gold IRAs have garnered significant attention as a hedge against inflation and economic uncertainty. This case study explores the intricacies of a Gold IRA, illustrating its benefits, potential drawbacks, and the experiences of a hypothetical investor, John Smith, who navigated the world of precious metals to secure his financial future.

Background

John Smith, a 45-year-old marketing executive, had been diligently saving for retirement for over two decades. As he approached his mid-40s, he became increasingly concerned about the volatility of the stock market and the potential impact of inflation on his savings. After conducting thorough research, John discovered the concept of a Gold IRA, which allows individuals to invest in physical gold and other precious metals as part of their retirement portfolio.

Understanding Gold IRAs

A Gold IRA is a self-directed individual retirement account that holds physical gold bullion, coins, and other approved precious metals. Unlike traditional IRAs that typically consist of stocks, bonds, and mutual funds, Gold IRAs provide investors with a tangible asset that has historically retained value over time. The primary appeal of Gold IRAs lies in their ability to serve as a hedge against economic downturns and inflation, making them an attractive option for risk-averse investors like John.

Setting Up a Gold IRA

To initiate the process, John first needed to select a reputable custodian who specializes in Gold IRAs. After extensive research and consultations, he chose a well-established company with a solid track record, transparent fee structures, and positive customer reviews. The custodian's role is crucial, as they manage the account, ensure compliance with IRS regulations, and facilitate the purchase and storage of the physical gold.

Once he selected a custodian, John funded his Gold IRA by rolling over a portion of his existing traditional IRA. This process involved completing the necessary paperwork and ensuring that the transfer adhered to IRS guidelines to avoid tax penalties. With the funds in place, John was ready to make his first purchase of gold.

Investing in Gold

John's next step was to choose the type of gold he wanted to invest in. He learned that the IRS has specific requirements regarding the purity and type of gold that can be held in a gold ira companies reviews IRA. For instance, gold coins must have a minimum purity of 99.5%, and certain bullion bars must meet specific standards.

After consulting with his custodian and conducting his own research, John decided to invest in a combination of gold bullion bars and American best rated gold ira companies Eagle coins. He appreciated the liquidity and recognition of the American Gold Eagle, while the bullion bars offered a cost-effective way to acquire larger quantities of gold.

Storage and Security

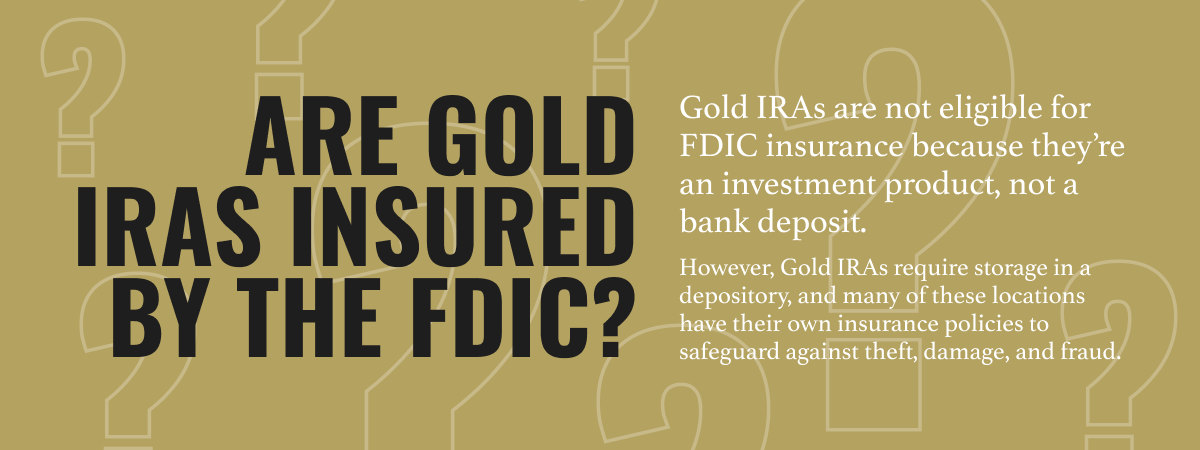

One of the critical aspects of owning a Gold IRA is the storage of the physical gold. The IRS mandates that gold held in a Gold IRA must be stored in an approved depository to ensure security and compliance. John’s custodian recommended several reputable depositories, and after evaluating their security measures, insurance policies, and fees, he opted for a facility that provided robust security features, including 24/7 surveillance and climate-controlled environments.

Monitoring and Performance

As the years passed, John diligently monitored the performance of his Gold IRA. He understood that gold prices fluctuate based on various factors, including geopolitical events, inflation rates, and currency strength. To stay informed, he subscribed to financial newsletters, followed market trends, and consulted with his custodian regularly.

During periods of economic uncertainty, such as the COVID-19 pandemic, John observed that gold prices surged as investors flocked to safe-haven assets. This volatility underscored the importance of diversifying his retirement portfolio, as the value of his Gold IRA increased significantly during these tumultuous times.

Tax Implications and Withdrawals

One of the advantages of a Gold IRA is the tax-deferred growth it offers. As long as John kept the gold in the IRA, he would not incur taxes on any gains. However, he was aware that withdrawals from a Gold IRA would be subject to ordinary income tax, and if he withdrew before the age of 59½, he would face an additional 10% penalty.

John planned his retirement strategy carefully, knowing he would need to account for these tax implications when the time came to withdraw funds. He also considered the option of taking a distribution in the form of physical gold, which could provide him with a tangible asset during retirement.

Potential Drawbacks

While John enjoyed the benefits of his Gold IRA, he also encountered some potential drawbacks. One significant concern was the fees associated with maintaining a Gold IRA. Custodial fees, storage fees, and transaction fees can add up, impacting overall returns. John made it a point to factor these costs into his investment strategy and remained vigilant about minimizing unnecessary expenses.

Additionally, John recognized that gold does not generate income like stocks or bonds. While it serves as a store of value, it does not pay dividends or interest. This realization prompted him to maintain a balanced portfolio that included other asset classes to ensure a steady income stream during retirement.

Conclusion

John Smith's journey into the world of Gold IRAs exemplifies the careful considerations and strategic planning required for successful retirement investing. By diversifying his portfolio with precious metals, he not only hedged against inflation and economic uncertainty but also gained peace of mind knowing he had a tangible asset to rely on.

As more investors seek alternative ways to secure their financial futures, Gold IRAs continue to gain popularity. However, they require thorough research, understanding of the associated costs, and careful consideration of individual financial goals. John's experience serves as a valuable case study for those contemplating the addition of gold to their retirement strategy, highlighting the importance of informed decision-making in the pursuit of long-term financial success.