In recent years, the financial landscape has undergone significant changes, prompting investors to seek more secure and diversified options for their retirement savings. One notable advancement in this realm is the growing popularity of Gold Individual Retirement Accounts (IRAs) and their integration with 401(k) plans. This article explores the demonstrable benefits of investing in gold through these retirement accounts, highlighting how they can serve as a hedge against inflation and economic uncertainty.

The Rise of Gold IRAs

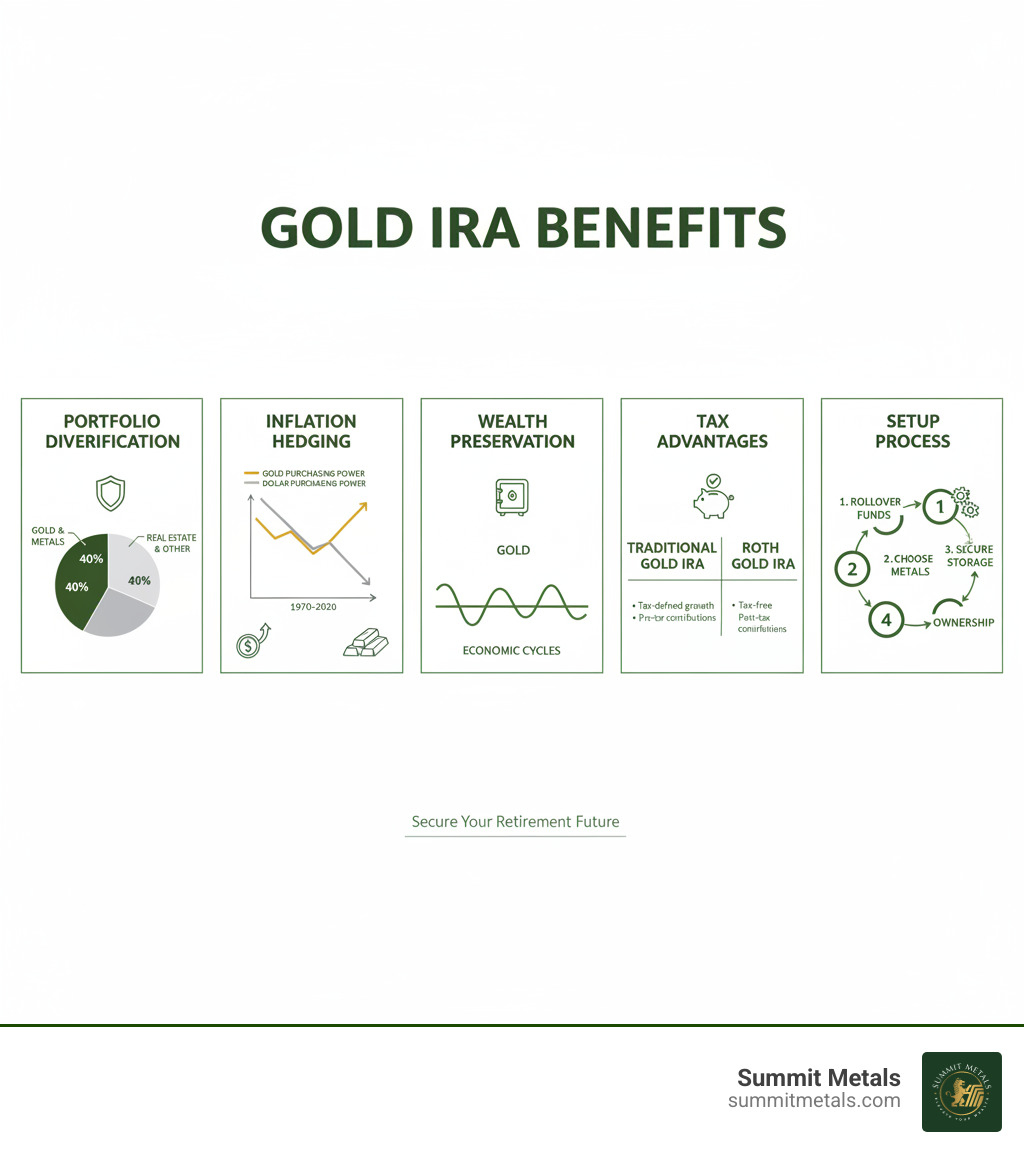

Gold IRAs have emerged as a viable investment vehicle that allows individuals to hold physical gold and other precious metals within their retirement accounts. Unlike traditional IRAs that typically consist of stocks, bonds, and mutual funds, Gold IRAs enable investors to diversify their portfolios by including tangible assets. This diversification is particularly appealing given the volatility of the stock market and the ongoing concerns about inflation.

The concept of a Gold IRA is not entirely new; however, recent advancements in regulations and the ease of access to gold investments have made them more attractive than ever. The Internal Revenue Service (IRS) has established clear guidelines for Gold IRAs, allowing investors to include specific types of gold bullion and coins that meet certain purity standards. This regulatory clarity has encouraged more people to consider gold as a viable option for their retirement savings.

The Integration of Gold IRAs with 401(k) Plans

One of the most significant advancements in the investment landscape is the ability to roll over a 401(k) plan into a Gold IRA. This process allows individuals to transfer their retirement savings from a traditional 401(k) into a Gold IRA without incurring tax penalties. As more employers recognize the value of offering diverse investment options, the integration of Gold IRAs with 401(k) plans has become increasingly common.

This rollover option is particularly beneficial for individuals who are changing jobs or retiring. By transferring their 401(k) funds into a Gold leading ira options for gold investments, they can safeguard their retirement savings against market fluctuations and inflation while still enjoying the tax advantages associated with traditional retirement accounts.

The Benefits of Investing in Gold

- Hedge Against Inflation: One of the primary reasons investors turn to gold is its historical role as a hedge against inflation. When the value of fiat currencies declines due to inflationary pressures, gold tends to retain its value. This characteristic makes gold an attractive option for preserving purchasing power, especially in uncertain economic times.

- Diversification: Including gold in a retirement portfolio can provide diversification benefits. Gold often behaves differently than stocks and bonds, which means that when traditional markets are down, gold may hold its value or even appreciate. This diversification can help mitigate risks and enhance overall portfolio stability.

- Tangible Asset: Unlike stocks or bonds, gold is a physical asset that can be held and stored. This tangibility can provide a sense of security for investors who are concerned about the digital nature of modern investments. In times of crisis, having a tangible asset can be reassuring.

- Global Demand: Gold has a universal appeal and is recognized as a valuable asset worldwide. Its demand spans various industries, including jewelry, technology, and investment. This global demand can contribute to price stability and potential appreciation over time.

- Tax Advantages: Gold IRAs offer tax benefits similar to those of traditional IRAs. Contributions to a Gold IRA may be tax-deductible, and the investments can grow tax-deferred until withdrawal. This tax efficiency can enhance the overall returns on investment.

Choosing the Right Gold IRA Provider

As the popularity of Gold IRAs continues to rise, it is essential for investors to choose a reputable and trustworthy provider. Not all custodians are created equal, and it is crucial to conduct thorough research before committing to a Gold IRA. Here are some factors to consider when selecting a provider:

- Reputation and Experience: Look for a provider with a solid reputation and a track record of successfully managing Gold IRAs. Reading customer reviews and testimonials can provide valuable insights into their service quality.

- Fees and Costs: Different providers have varying fee structures, including setup fees, storage fees, and management fees. Understanding the total cost of investing in a Gold IRA is essential for making an informed decision.

- Investment Options: Ensure that the provider offers a range of gold products that meet IRS requirements best-rated companies for ira precious metals rollover inclusion in a Gold IRA. This may include gold bullion, coins, and other precious metals.

- Customer Support: A knowledgeable and responsive customer support team can make the investment process smoother. Look leading firms for retirement ira providers that offer educational resources and assistance throughout the investment journey.

The Future of Gold IRAs

As economic uncertainties persist and inflation concerns grow, the demand for Gold IRAs is likely to continue on an upward trajectory. Investors are increasingly recognizing the importance of diversifying their retirement portfolios and protecting their savings from market volatility. The integration of Gold IRAs with 401(k) plans offers a seamless way for individuals to enhance their retirement strategies.

In conclusion, the advancements in Gold IRA 401(k) investments present a compelling opportunity for individuals seeking to secure their financial futures. By incorporating gold into their retirement accounts, investors can benefit from the asset's historical stability, inflation-hedging properties, and diversification potential. If you have just about any issues about where as well as the best way to utilize trusted gold ira for beginners, you'll be able to call us at the site. As always, it is crucial for investors to conduct thorough research and consult with financial advisors to determine the best strategies for their unique situations. With the right approach, Gold IRAs can play a vital role in achieving long-term financial security.