In recent years, the appeal comprehensive reviews of the best gold ira companies investing in gold has surged, particularly among those looking to secure their retirement savings. A Gold IRA (Individual Retirement Account) rollover allows investors to transfer their existing retirement accounts into gold-backed assets, providing a hedge against inflation and market volatility. This case study explores the best practices for executing a Gold IRA rollover, examining the steps involved, potential benefits, and considerations to keep in mind.

Understanding Gold IRA Rollovers

A Gold ira investing best gold ira companies rollover is a process where funds from an existing retirement account, such as a 401(k) or traditional IRA, are transferred into a self-directed IRA that holds physical gold or other precious metals. This type of investment is particularly appealing to those who wish to diversify their portfolios and protect their wealth from economic uncertainty.

The Rollover Process

- Choose a Reputable Custodian: The first step in the rollover process is selecting a custodian that specializes in Gold IRAs. The custodian is responsible for managing the account and ensuring compliance with IRS regulations. It is essential to choose a custodian with a solid reputation, transparent fees, and excellent customer service. Researching reviews of the best gold ira companies and seeking recommendations can help in making an informed decision.

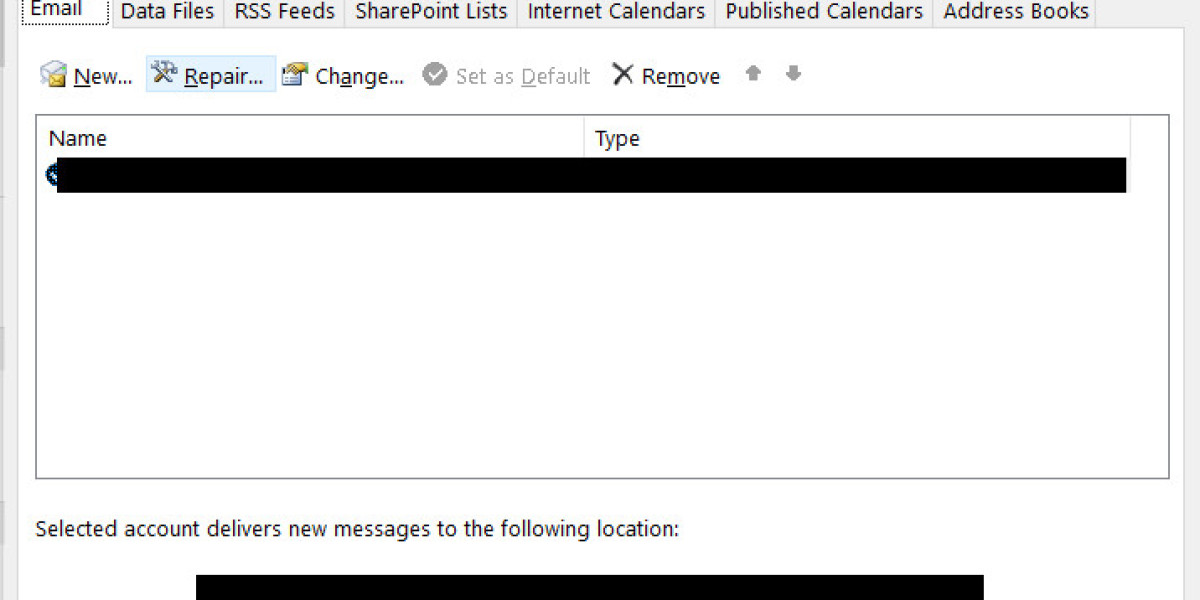

- Initiate the Rollover: Once a custodian is selected, the next step is to initiate the rollover. This typically involves filling out paperwork to request the transfer of funds from the existing retirement account. The custodian will guide the account holder through this process, ensuring that all necessary documentation is completed accurately.

- Select Gold Investments: After the funds have been successfully transferred into the Gold IRA, the investor can choose which gold assets to purchase. These may include gold bullion, coins, or ETFs that are backed by physical gold. It is crucial to ensure that the selected investments meet IRS requirements for gold IRAs, which typically stipulate a minimum purity level.

- Complete the Purchase: Once the gold investments are selected, the custodian will facilitate the purchase. The physical gold must be stored in an IRS-approved depository to comply with regulations. The custodian will usually have partnerships with secure storage facilities to ensure the safety of the assets.

- Monitor and Manage the Account: After the rollover is complete and the gold is purchased, it is essential to monitor the performance of the Gold IRA. Regularly reviewing the account and staying informed about market trends can help investors make strategic decisions regarding their investments.

Benefits of a Gold IRA Rollover

- Inflation Hedge: Gold has historically been viewed as a safe-haven asset during times of economic uncertainty. By investing in gold, individuals can protect their retirement savings from inflation and currency devaluation.

- Diversification: A Gold IRA provides an opportunity to diversify an investment portfolio. By including precious metals, investors can reduce their exposure to traditional assets like stocks and bonds, which may be more volatile.

- Tax Advantages: Gold IRAs offer similar tax benefits to traditional IRAs. Contributions may be tax-deductible, and the investments grow tax-deferred until withdrawal. Additionally, qualified distributions may be taxed at a lower rate.

- Control Over Investments: A self-directed Gold IRA allows investors to have more control over their retirement assets. They can choose which types of gold or precious metals to invest in, tailoring their portfolios to their risk tolerance and investment goals.

Considerations Before Rolling Over to a Gold IRA

- Fees and Costs: While Gold IRAs can be advantageous, they often come with higher fees compared to traditional IRAs. Investors should be aware of setup fees, storage fees, and management fees associated with maintaining a gold ira companies for retirees IRA.

- IRS Regulations: The IRS has specific rules governing Gold IRAs, including the types of gold that can be held and the required purity levels. Investors must ensure that they comply with these regulations to avoid penalties or disqualification of the account.

- Market Volatility: Although gold is considered a stable investment, it is not immune to price fluctuations. Investors should be prepared for potential changes in the market value of their gold holdings and have a long-term strategy in place.

- Liquidity: While gold can be a valuable asset, it may not always be as liquid as other investments. Selling gold ira companies usa may take time and could involve additional costs, so investors should consider their liquidity needs when investing in a Gold IRA.

Conclusion

A Gold IRA rollover can be an effective strategy for individuals looking to safeguard their retirement savings against economic uncertainties. By understanding the rollover process, selecting a reputable custodian, and being aware of the benefits and considerations, investors can make informed decisions that align with their financial goals. As with any investment, it is essential to conduct thorough research and seek professional advice to ensure that a Gold IRA is the right fit for one’s retirement strategy. In the end, the best Gold IRA rollover is one that is tailored to the individual's unique financial situation and long-term objectives.