Lately, the funding landscape has seen a big shift as people search to diversify their portfolios and safeguard their wealth towards financial uncertainties. Probably the most appealing choices that has gained traction is investing in gold via a Self-Directed Particular person Retirement Account (IRA). As inflation concerns rise and market volatility persists, many investors are turning to gold as a dependable hedge and a technique of preserving their buying energy. This article explores the ins and outs of IRA gold investing, its benefits, and the issues that potential investors should keep in mind.

Understanding IRA Gold Investing

An IRA, or Particular person Retirement Account, is a tax-advantaged account that allows people to avoid wasting for retirement with various investment choices. Whereas traditional IRAs usually embody stocks, bonds, and mutual funds, a Self-Directed IRA offers traders the flexibleness to include various assets, such as precious metals like gold. This selection allows individuals to take management of their retirement savings and invest in bodily gold bullion or coins, which can present a hedge against inflation and economic downturns.

The advantages of Investing in Gold by means of an IRA

- Inflation Hedge: Traditionally, gold has been considered as a safe haven asset throughout occasions of financial instability. When inflation rises, the best gold ira companies buying energy of fiat forex declines, making tangible property like gold more beneficial. By including gold in an IRA, buyers can protect their retirement savings from the eroding effects of inflation.

- Diversification: A well-diversified portfolio is important for managing risk. Gold usually behaves differently than stocks and bonds, which means that when traditional markets are down, gold prices could rise. By including gold to an IRA, traders can obtain better diversification and probably increase their total returns.

- Tax Advantages: Investing in gold by means of an IRA affords vital tax advantages. Positive factors from gold investments held within an IRA are tax-deferred till withdrawal, allowing for potential compounding development without the immediate tax burden. Moreover, if a Roth IRA is used, qualified withdrawals could even be tax-free.

- Tangible Asset: In contrast to stocks and bonds, which are intangible, gold is a physical asset that traders can hold. This tangible nature can provide a way of security, particularly during intervals of financial uncertainty.

How one can Get Started with IRA Gold Investing

Investing in gold via an IRA requires a couple of key steps:

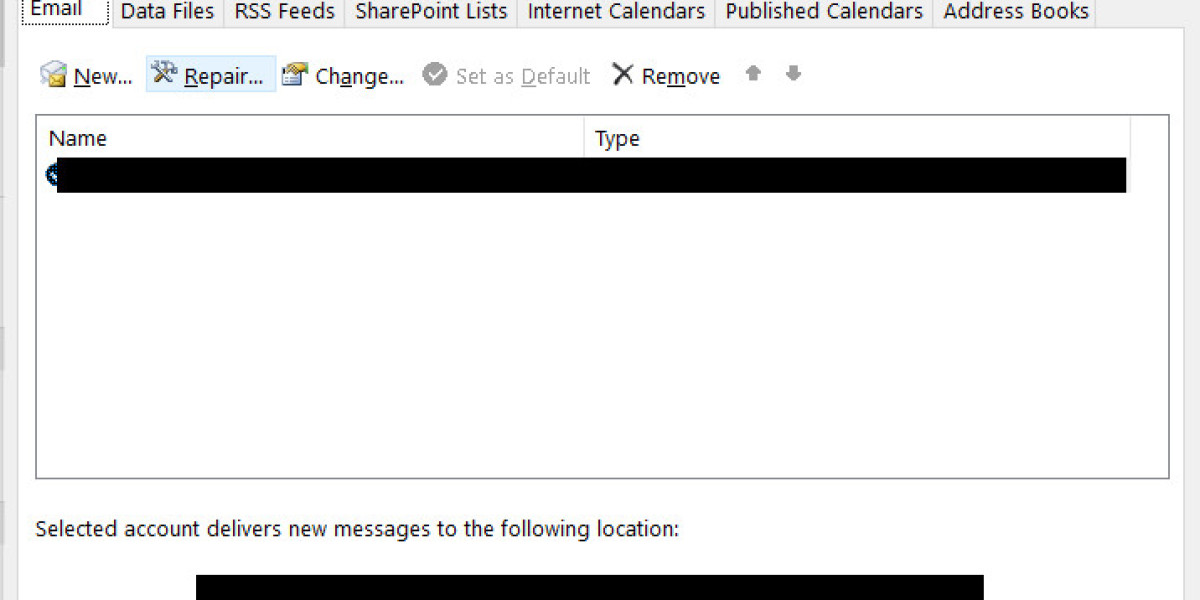

- Select a Custodian: The first step is best company to rollover ira to gold select a reputable custodian that focuses on Self-Directed IRAs and is authorized to hold valuable metals. The custodian will handle the account and ensure compliance with IRS regulations.

- Open a Self-Directed IRA: Once a custodian is chosen, people can open a Self-Directed IRA. This course of usually involves filling out an application and providing necessary documentation.

- Fund the Account: Buyers can fund their Self-Directed IRA through various means, reminiscent of transferring funds from an current retirement account or making a new contribution. It’s important to concentrate on contribution limits and tax implications.

- Choose Gold Merchandise: After funding the account, buyers can select the particular gold merchandise they want to buy. The IRS has strict guidelines concerning the kinds of gold that can be held in an IRA. Typically, solely gold bullion and sure coins that meet particular purity standards are eligible.

- Storage: Gold held in an IRA have to be saved in an permitted depository. The custodian will arrange for the safe storage of the bodily gold, guaranteeing that it meets all regulatory requirements.

Considerations and Dangers

While investing in gold through an IRA presents quite a few benefits, there are additionally concerns and risks that traders ought to remember of:

- Fees: Self-Directed IRAs usually come with greater fees in comparison with traditional IRAs. Custodial fees, storage fees, and transaction costs can add up, which can influence overall returns.

- Market Volatility: Although gold ira companies in usa is considered a safe haven, it isn't immune to cost fluctuations. Buyers needs to be ready for potential volatility within the gold market and understand that costs can fluctuate based mostly on international financial conditions.

- Regulatory Compliance: The IRS has particular rules concerning the varieties of gold that may be held in an IRA and the way it should be saved. Failure to adjust to these laws can result in penalties and tax penalties.

- Lengthy-Term Funding: Gold must be seen as a long-time period investment relatively than a short-term buying and selling car. Buyers ought to have a clear technique and be prepared to hold their 5 best gold ira companies investments for an prolonged interval to realize potential positive factors.

Conclusion

As economic uncertainty continues to loom, investing in gold through a Self-Directed IRA presents a singular alternative for individuals seeking to diversify their retirement portfolios and protect their wealth. With its historic significance as a hedge against inflation and market volatility, gold stays a compelling asset for investors. Nonetheless, it is essential to approach IRA gold investing with a clear understanding of the advantages, risks, and regulatory requirements concerned.

For those contemplating this investment technique, conducting thorough research and consulting with monetary advisors or tax professionals may also help guarantee a well-informed decision. As the funding panorama evolves, gold might proceed to shine as a valuable part of a balanced retirement portfolio, providing both security and growth potential for the long run.