In recent years, the interest in gold as an investment vehicle has surged, particularly in the context of Individual Retirement Accounts (IRAs). A physical gold IRA rollover allows investors to transfer funds from a traditional IRA or another retirement account into a gold-backed IRA, enabling them to hold physical gold as part of their retirement portfolio. This article explores the process, Gold ira rollover benefits, and gold ira rollover considerations surrounding physical gold IRA rollovers through observational research.

The Rise of Gold IRAs

The allure of gold as a hedge against inflation and economic uncertainty has historically attracted investors. With stock market volatility and rising inflation rates, many individuals have turned to physical gold as a safe haven. According to recent surveys, a significant percentage of investors now consider gold IRAs as a viable alternative for preserving wealth. Observational data indicates that this trend is particularly pronounced among retirees and those approaching retirement age, who seek to safeguard their savings against market fluctuations.

Understanding the Rollover Process

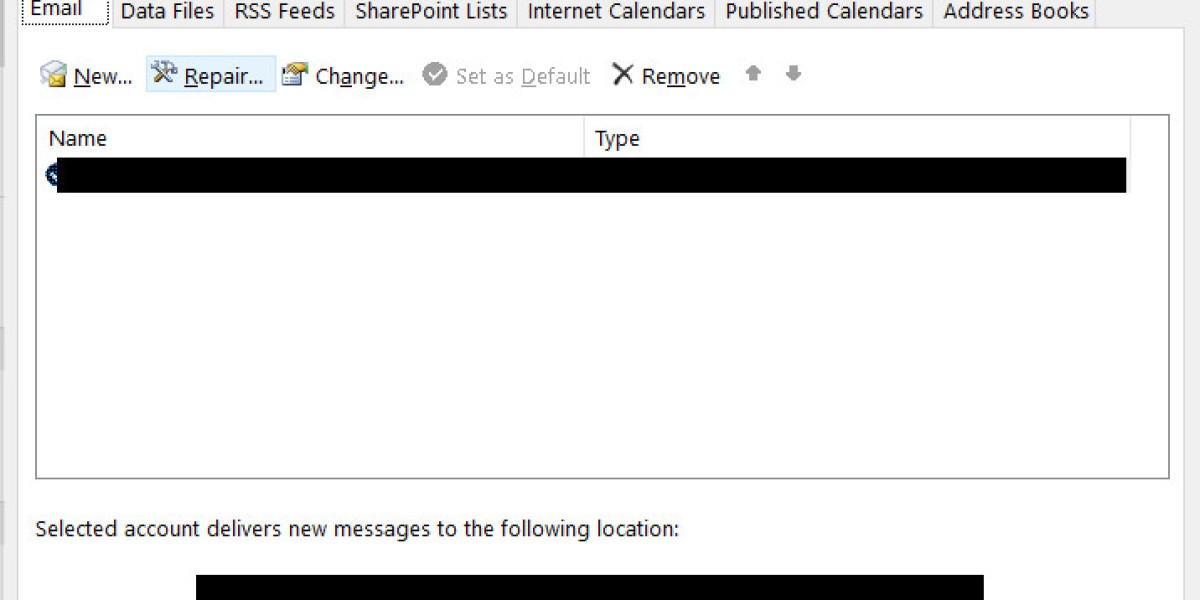

The rollover process involves several key steps. Firstly, an investor must choose a custodian that specializes in gold IRAs. This custodian will manage the account and ensure compliance with IRS regulations. Observationally, many investors prefer custodians with established reputations and transparent fee structures.

Once a custodian is selected, the next step is to initiate a rollover. This can be done by contacting the current IRA provider and requesting a transfer of funds. Observationally, investors often report anxiety during this phase, fearing potential tax implications or penalties. However, when executed correctly, a rollover can be completed without incurring taxes.

Upon receiving the funds, the custodian will facilitate the purchase of physical gold. Investors can choose from various forms of gold, including bullion bars, coins, or other approved products. Observationally, preferences vary, with some investors favoring gold coins for their historical value and others opting for Gold IRA rollover bullion for its lower premiums.

Benefits of Physical Gold IRAs

One of the primary benefits of a physical gold IRA rollover is the diversification it offers. By incorporating gold into their retirement portfolios, investors can reduce their overall risk exposure. Observationally, many investors report feeling more secure knowing that a portion of their retirement savings is backed by tangible assets.

Another significant advantage is the potential for long-term appreciation. Historically, gold has maintained its value over time, even during economic downturns. Observational data shows that investors who include gold in their retirement plans often experience less volatility in their overall portfolio performance.

Additionally, physical gold IRAs provide a hedge against inflation. As the cost of living rises, the value of gold typically increases, preserving purchasing power. Observationally, many investors express a preference for gold as a safeguard against inflationary pressures, particularly in uncertain economic climates.

Considerations and Challenges

While the benefits of a physical gold IRA rollover are compelling, there are also challenges to consider. One significant hurdle is the initial investment required to purchase physical gold. Observationally, many investors find the upfront costs daunting, particularly for those who may have limited funds in their retirement accounts.

Another consideration is the storage and security of physical gold. Unlike traditional assets, gold must be stored securely to prevent theft or damage. Observationally, investors often express concern about the logistics of storing their gold, leading them to seek custodians that offer secure storage solutions.

Moreover, the regulatory landscape surrounding gold IRAs can be complex. Observationally, investors frequently report feeling overwhelmed by the myriad of rules governing gold investments, including IRS requirements for purity and gold ira rollover acceptable forms of gold. This complexity can deter some individuals from pursuing a gold IRA rollover.

The Role of Education and Resources

To navigate the challenges associated with physical gold IRA rollovers, education and access to resources are paramount. Observationally, investors who engage in thorough research before initiating a rollover tend to feel more confident in their decisions. Many turn to online forums, educational webinars, and financial advisors specializing in precious metals to gain insights into the process.

Additionally, reputable custodians often provide educational materials and resources to help investors understand the intricacies of gold IRAs. Observationally, those who utilize these resources report a smoother rollover experience and a greater sense of empowerment in managing their retirement investments.

Conclusion

Physical gold IRA rollovers present a unique opportunity for investors seeking to diversify their retirement portfolios and protect their wealth against economic uncertainty. While the process involves several steps and considerations, observational research indicates that many individuals find the potential benefits outweigh the challenges. As the interest in gold as an investment continues to grow, it is essential for investors to educate themselves and seek guidance from reputable custodians to navigate the complexities of gold IRAs effectively. Ultimately, gold IRA rollover a well-executed physical gold IRA rollover can serve as a valuable component of a comprehensive retirement strategy, providing security and peace of mind for the future.