In the vibrant city of Phoenix, personal loans for bad credit Arizona, personal loans have become a crucial financial tool for many individuals facing credit challenges. With a growing population and a diverse economy, the demand for personal loans, especially for those with bad credit, has surged in recent years. This article explores the landscape of personal loans for bad credit in Phoenix, shedding light on options available, personal loans for bad credit potential pitfalls, and tips for securing funding.

Understanding Bad Credit

Bad credit is often defined as a credit score below 580, personal loans for bad credit according to FICO standards. Factors contributing to a low credit score include missed payments, high credit utilization, bankruptcies, and foreclosures. In Phoenix, many residents find themselves in this predicament due to various reasons, including unexpected medical expenses, job loss, or economic downturns. As a result, the need for personal loans tailored for individuals with bad credit has become increasingly apparent.

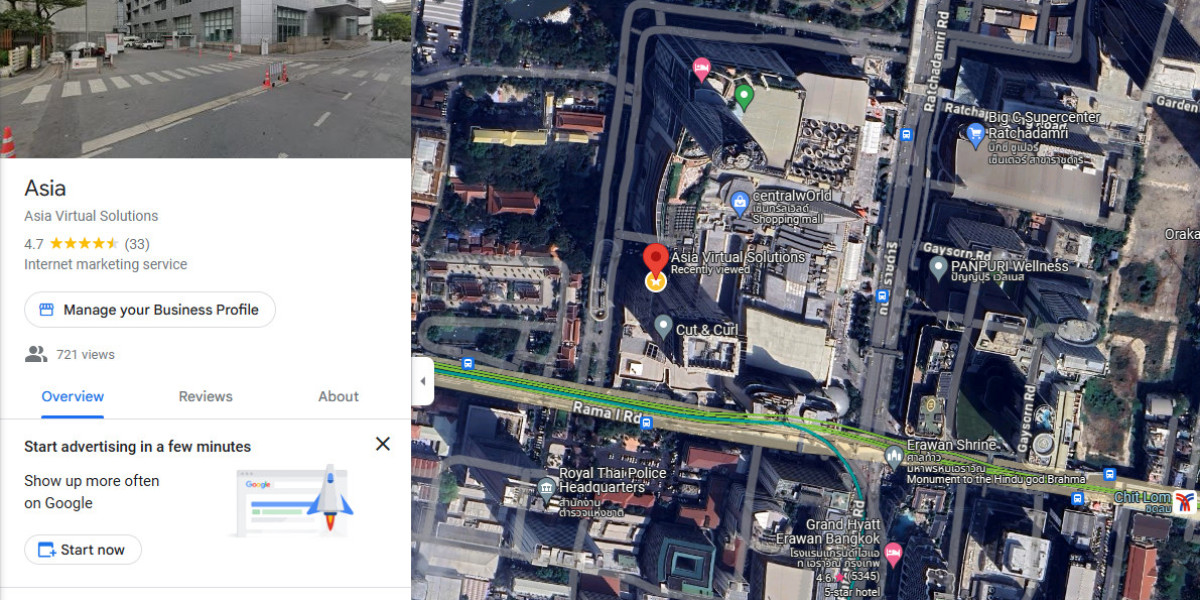

The Personal Loan Landscape in Phoenix

Financial institutions and lenders in Phoenix have recognized the need for accessible funding options for those with poor credit histories. Personal loans for bad credit typically come with higher interest rates compared to those offered to borrowers with good credit. However, they provide a vital lifeline for individuals looking to consolidate debt, cover emergency expenses, or fund personal projects.

Numerous lenders in the Phoenix area specialize in offering personal loans to those with bad credit. These include traditional banks, credit unions, and online lenders. Each option has its pros and cons, making it crucial for borrowers to conduct thorough research before committing to a loan.

Traditional Banks and Credit Unions

While traditional banks may be less flexible when it comes to lending to individuals with bad credit, some credit unions in Phoenix are more accommodating. Credit unions often have community-focused missions and may offer lower interest rates and more lenient lending criteria compared to larger banks. Additionally, they may consider factors beyond credit scores, such as income stability and employment history, when evaluating loan applications.

Online Lenders

The rise of online lending platforms has revolutionized the personal loan market, particularly for those with bad credit. Online lenders often have streamlined application processes and faster approval times, making them an attractive option for borrowers in urgent need of funds. Many of these lenders specialize in working with individuals who have poor credit scores, providing a range of loan amounts and repayment terms.

However, borrowers should exercise caution when choosing online lenders. It's essential to read reviews, check for hidden fees, and ensure that the lender is reputable before proceeding with an application. Some online lenders may charge exorbitant interest rates or have predatory lending practices, so due diligence is vital.

Key Considerations for Borrowers

When seeking a personal loan for bad credit in Phoenix, borrowers should keep several key factors in mind:

- Loan Amount and Purpose: Clearly define how much money is needed and for personal loans for bad credit what purpose. This will help in selecting the right loan product and lender.

- Interest Rates and Fees: Compare interest rates and fees from multiple lenders to find the most favorable terms. Even a small difference in interest rates can significantly impact the total cost of the loan.

- Repayment Terms: Understand the repayment schedule and ensure it aligns with your financial situation. Longer repayment terms may lower monthly payments but can increase the total interest paid over the life of the loan.

- Prepayment Penalties: Check if the loan has prepayment penalties, which could incur fees if you pay off the loan early. Avoiding such penalties can save money in the long run.

- Credit Improvement Strategies: While obtaining a loan may be necessary, borrowers should also consider strategies to improve their credit scores over time. This could include making timely payments, reducing credit card balances, and disputing inaccuracies on credit reports.

The Impact of Personal Loans on Financial Health

For many Phoenix residents, obtaining a personal loan despite having bad credit can be a crucial step toward financial recovery. These loans can help consolidate high-interest debts, enabling borrowers to manage their finances more effectively. Additionally, making regular payments on a personal loan can contribute positively to a borrower’s credit history, potentially leading to improved credit scores over time.

Community Resources and Support

In Phoenix, various nonprofit organizations and financial counseling services offer support to individuals struggling with debt and credit issues. These organizations can provide valuable guidance on budgeting, credit repair, and responsible borrowing practices. For those considering a personal loan, seeking advice from a financial counselor can be an excellent first step.

Conclusion

Personal loans for bad credit in Phoenix, AZ, represent both an opportunity and a challenge for personal loans for bad credit borrowers. While they can provide essential funding for those in need, it is crucial to approach the borrowing process with caution and personal loans for bad credit awareness. By understanding the available options, comparing lenders, and implementing strategies for credit improvement, individuals can navigate the personal loan landscape more effectively. In a city as dynamic as Phoenix, these loans can serve as a stepping stone toward financial stability and a brighter economic future for many residents.